Is MoneyLion Legit? Complete Review, Pros, Cons & Safety Guide

Is MoneyLion legit? Explore MoneyLion’s safety, pros, cons, fees, customer reviews, credit tools, cash advances, and whether the app is worth using.

MoneyLion is one of the most widely searched financial apps in the U.S., thanks to its cash advances, mobile banking, and credit-building tools. But as more users turn to fintech platforms for fast cash and flexible banking, one question keeps coming up:

Is MoneyLion legit—or is it risky?

The short answer: MoneyLion is a legitimate, regulated financial technology company.

But that doesn’t mean it’s perfect.

MoneyLion has millions of users, a strong digital presence, real financial services, and partnerships that verify its legitimacy. However, like many fintech apps, it also receives mixed reviews—particularly around fees, customer support, and account issues.

This in-depth guide breaks down everything you need to know before using MoneyLion. You’ll learn:

- What MoneyLion is and how it works

- Whether it’s safe

- Real pros and cons

- Whether cash advances and loans are worth it

- Who MoneyLion is best for

- Who should avoid it

- Better alternatives depending on your financial goals

Let’s dive in.

What Is MoneyLion? How the App Works

MoneyLion is a U.S.-based fintech platform founded in 2013. Its mission is to give Americans—especially those underserved by traditional banks—access to flexible banking tools, cash advances, and credit support.

According to sources like MoneyLion’s publicly available product disclosures, the platform offers a mix of:

1. Cash Advances (Instacash)

This feature provides small cash advances—often up to a few hundred dollars—before payday. Users like it because:

- No traditional credit check is required

- Funds can be deposited quickly

- It fills short-term cash gaps

However, optional “turbo” fees may apply for instant delivery.

2. Credit Builder Loans

These loans are designed for people who want to improve or rebuild credit. How it works:

- You borrow a small amount (e.g., $300–$1,000)

- Repay monthly

- Payments are reported to major credit bureaus

- Part of the loan is held until you finish repaying

This can be helpful—but only when payments are made on time.

3. RoarMoney Banking (Mobile Banking)

MoneyLion offers a digital checking account with features like:

- No minimum balance

- Access to a wide ATM network

- Early direct deposits for some users

- A virtual and physical debit card

This is designed as an alternative to traditional banks.

4. Personal Loan Marketplace

Instead of issuing all loans directly, MoneyLion also partners with other lenders. Users can compare:

- Rates

- Terms

- Fees

- Eligibility requirements

5. Investment Features

MoneyLion provides automated investing tools for beginners. This includes:

- Basic portfolios

- Automated deposits

- Round-up features

While convenient, these investments are not meant for advanced investors.

Is MoneyLion Legit? The Short Answer

Yes—MoneyLion is legit. It’s a real fintech company offering real financial services used by millions of people across the U.S. Since launching in 2013, the platform has grown into one of the most recognizable names in digital banking and credit support. But understanding its legitimacy also means knowing how it operates and how users rate their experience.

What Makes MoneyLion Legitimate?

MoneyLion’s legitimacy comes from more than just its popularity. The platform operates within regulated financial frameworks, has millions of active users, and offers real services backed by established partners. Below are the key factors that confirm MoneyLion is a genuine fintech company—not a scam.

1. Registered, Regulated Business

MoneyLion operates under U.S. financial rules and works with regulated banking partners. This ensures compliance with industry standards rather than operating as an unregulated loan app.

2. Millions of Verified Users

MoneyLion has served a large, active user base for more than a decade—something no scam could sustain long-term.

3. Backed by Established Financial Partners

Its banking features, cash advances, and credit tools rely on regulated institutions, which adds additional layers of security and oversight.

4. Transparent Terms and Disclosures

Users can view fees, loan terms, membership details, and product conditions directly within the app. Nothing is hidden—you just need to read the fine print carefully.

5. Reviewed by Reputable Publications

MoneyLion has been analyzed by trusted financial sources, including outlets such as Yakima Herald and Investopedia, which recognize it as a legitimate fintech provider—though not without its drawbacks.

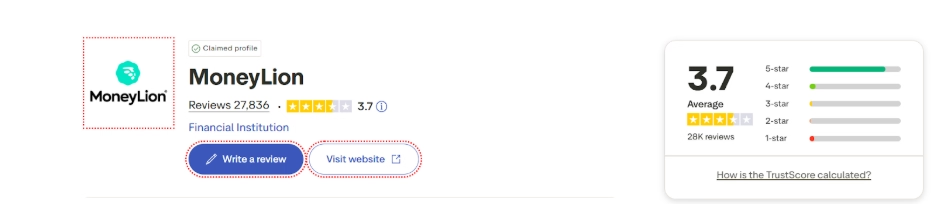

6. Trustpilot Rating: Mixed but Authentic

MoneyLion currently holds a 3.7 out of 5 rating on Trustpilot, based on tens of thousands of reviews.

This rating reflects genuine user experiences—both positive and negative.

Many users praise the app’s cash advances and credit tools, while others report issues with customer support, unexpected charges, or account access problems.

Being legit does NOT mean risk-free.

MoneyLion is a real financial platform, but it also receives thousands of user complaints—and many of them highlight areas where the app can be frustrating or costly if you’re not careful.

To decide whether it’s truly worth using, you need to understand both the advantages and the downsides, which we explore next.

Pros and Cons of MoneyLion

MoneyLion offers a mix of helpful financial tools, but it also comes with certain drawbacks that users should understand before signing up. To help you make an informed decision, here’s a clear breakdown of the biggest advantages and disadvantages based on real user experiences and platform data.

MoneyLion Pros — What the App Does Well

MoneyLion has strengths that appeal to users who need flexible financial support.

1. Fast Access to Cash With Instacash

Instacash is one of MoneyLion’s most popular features. It allows users to:

- Access cash before payday

- Avoid traditional payday lenders

- Borrow small amounts with no credit check

For many, it’s a quick, convenient option during emergencies.

2. Helpful for Building or Repairing Credit

MoneyLion’s credit-building loan can be beneficial for people who:

- Have poor credit

- Are new to credit

- Need positive payment history

- Want a structured way to rebuild

Payments are reported to major bureaus—meaning consistent repayment can improve your score.

3. Mobile Banking Convenience (RoarMoney)

MoneyLion’s banking account offers:

- No minimum balance

- Early direct deposit (for some users)

- Access to a large ATM network

- A virtual card for online purchases

For people who don’t want a traditional bank, this is appealing.

4. Easy-to-Use App

MoneyLion is designed for simplicity. Users enjoy:

- A modern interface

- Easy sign-up

- Quick approvals

- All-in-one tools

For many, MoneyLion is easier to use than a standard bank’s app.

5. Financial Tools for Underserved Users

MoneyLion is especially helpful for:

- Gig workers

- Freelancers

- Low-credit individuals

- People without stable banking

- Those who need short-term financial help

Traditional banks often reject these users, making MoneyLion a useful alternative.

MoneyLion Cons — What Users Should Watch Out For

Despite being legitimate, MoneyLion comes with real drawbacks.

1. Fees Can Add Up

While MoneyLion advertises low-cost cash advances, users often report:

- “Turbo” fees to get money faster

- Optional monthly memberships

- Extra fees for certain transactions

Even small fees add up over time.

2. Customer Support Complaints

MoneyLion’s customer support receives many negative reviews, especially regarding:

- Account lockouts

- Withdrawal issues

- Membership cancellations

- Difficulty reaching support

- Delayed responses

This is a recurring complaint across multiple review platforms.

3. Issues With Subscriptions and Memberships

Some users report that:

- Membership fees continued after cancellation

- They were charged unexpectedly

- Refunds were difficult to obtain

It’s important to read the fine print and turn off auto-renewal options.

4. Cash Advances Can Encourage Bad Habits

MoneyLion is NOT a long-term financial solution. Using Instacash frequently may:

- Create dependency

- Lead to repeat borrowing

- Cause fee accumulation

- Make budgeting difficult

It’s helpful for emergencies—not regular income.

5. Mixed Trustpilot Rating

MoneyLion’s Trustpilot score is mixed, with tens of thousands of reviews.

Common positive themes:

- Fast access to cash

- Easy approval

- Good for building credit

Common negative themes:

- Customer service issues

- Unexpected charges

- Account access problems

- Delayed deposits

This mixed rating shows the service helps some users but frustrates others.

Is MoneyLion Safe for Banking?

MoneyLion’s RoarMoney account is safe in the sense that:

- Funds are held with regulated banking partners

- Debit card protections apply

- Fraud detection systems are in place

However, users should be aware:

- Customer support delays can be frustrating

- Withdrawal or access problems can occur

- Banking services may not match traditional banks’ reliability

It’s safe, but not necessarily as stable as major banks.

Is MoneyLion Safe for Borrowing?

MoneyLion’s cash advances are generally safe if used responsibly.

Safe aspects:

- No traditional credit check

- Transparent repayment scheduling

- App-managed borrowing

Risks:

- Optional fees increase cost

- Frequent borrowing leads to financial dependence

- Late payments on credit-builder loans can hurt your credit score

It’s best used as a backup plan—not your main income tool.

Who Is MoneyLion Good For?

MoneyLion is a practical tool for people who need flexible, short-term financial support rather than a full banking replacement. It’s especially helpful if you prefer managing money through a modern app and don’t qualify easily for traditional financial products.

MoneyLion works best for:

- People needing occasional short-term cash : If you only borrow once in a while, Instacash can help you bridge small financial gaps without relying on payday loans.

- Individuals looking to build or rebuild credit: The credit-builder loan can be useful for improving your score—as long as you can commit to timely monthly payments.

- Users who prefer app-based money management: If you like the convenience of mobile-first banking, MoneyLion’s interface and tools will feel intuitive and easy to use.

- People with limited access to traditional banks: Gig workers, freelancers, or individuals with poor credit may find MoneyLion more accessible than standard banks.

- Those who can manage small loans responsibly: If you have good budgeting habits and do not rely on advances regularly, MoneyLion can be a helpful financial supplement.

In simple terms, MoneyLion is great as an additional financial tool—not the center of your entire financial system.

Who Should Avoid MoneyLion?

While MoneyLion is legitimate, it’s not the best fit for everyone. Some users may find the fees, customer service issues, or borrowing structure inconvenient or risky.

MoneyLion may NOT be ideal for:

- People who prefer simple, fee-free banking: The app includes optional membership fees, turbo fees for instant transfers, and other charges that can add up.

- Users who rely heavily on cash advances: Using Instacash too often can become a cycle that leads to dependency and repeated borrowing.

- Anyone who expects strong, fast customer support: Many user complaints highlight slow responses, difficulty canceling services, or issues resolving account problems.

- People looking for stable, long-term financial tools: If your goal is high-yield savings or reliable day-to-day banking, traditional banks are usually better.

- Individuals uncomfortable with fintech banking risks: If you prefer in-person service, clear fee structures, or guaranteed access to funds, MoneyLion may feel unpredictable.

Overall, MoneyLion can be useful when used carefully, but it’s not ideal for people who need long-term financial stability, consistent support, or fee-free services. Traditional banks remain the better choice for those priorities.

Tips for Using MoneyLion Safely

If you decide to use MoneyLion, follow these tips:

- Avoid using cash advances as regular income

- Read membership and fee details closely

- Track withdrawals and deposits regularly

- Use credit-builder loans only if you can make payments reliably

- Turn off auto-renewal subscriptions you don’t need

- Keep screenshots of any support interactions

- Monitor your bank statements for unexpected charges

These practices reduce the chance of unwanted surprises.

Final Verdict: Is MoneyLion Worth It?

MoneyLion is a legitimate and regulated fintech platform that offers real financial tools—cash advances, credit-builder loans, mobile banking, and basic investing features. For many users, it provides fast, convenient support when traditional banks fall short, especially for those with limited credit history or irregular income.

However, like any financial app, it comes with trade-offs. Fees can add up if you’re not careful, customer support can be inconsistent, and relying too heavily on cash advances may lead to unhealthy financial habits. MoneyLion works best as a supplement, not a replacement, for your primary financial system.

If you need occasional short-term help, want to build credit responsibly, or prefer app-based money management, MoneyLion can be a useful tool. But if you're looking for long-term stability, fee-free banking, or stronger support, traditional banking options may serve you better.

The key is to use MoneyLion mindfully—understanding its strengths, its limits, and how it fits into your financial goals.

FAQs About MoneyLion

Is MoneyLion safe to use?

Yes, MoneyLion is safe and operates legally. However, users should be mindful of fees, membership charges, and potential customer service delays. It’s safe for responsible borrowers but not ideal for repeated cash advances.

Does MoneyLion charge hidden fees?

MoneyLion discloses fees, but some users feel charges—like turbo fees for instant transfers or membership costs—are not always clear upfront. Always review the fee schedule before using its services.

Can MoneyLion improve your credit?

Yes, MoneyLion’s credit-builder loans report payments to credit bureaus. Timely payments help your score, but missed payments can hurt it. Use the loan only if you can commit to monthly payments.

Why does MoneyLion have mixed reviews?

Positive reviews highlight fast cash access and ease of use. Negative reviews often mention customer support issues, unexpected charges, or account access problems. The mixed rating reflects inconsistent user experiences.

Is MoneyLion better than traditional banks?

Not necessarily. MoneyLion offers convenience and ease, but traditional banks provide greater stability, stronger customer support, and clearer fee structures. MoneyLion works better as a supplemental tool, not a full replacement.

Launch your dropshipping business now!

Start free trialRelated blogs

.avif)

How Does 2 Day Shipping Work?

Understand 2 day shipping, how carriers count days, cutoffs, zones, costs, and how ecommerce brands offer affordable 2 day shipping.

Zendrop Reviews: Is Zendrop Legit for Dropshipping?

Read real Zendrop reviews from Shopify and Trustpilot, explore pricing, features, pros and cons, and decide if Zendrop is legit for your store.

How to Choose a Brand Name

Learn how to choose a brand name with proven frameworks, testing steps, and trademark checks so it’s memorable, available, and built to scale.